Letters of Credit and Bills of Lading in

Commercial Transactions

Two

important documents are commonly required for a commercial transaction

involving the exchange and transport of a good between a buyer and a seller:

- Letter of credit. A document issued by a financial institution that

provides a promise of payment for a trade transaction, implying that it

can be redeemed if certain conditions are satisfied. They are mainly used

in international trade for transactions between actors, such as a buyer

and a seller, in different countries.

- Bill of lading. A document that establishes evidence and the terms of

a contract between a shipper, a transportation company and the agents

providing and receiving the cargo. It serves as a document of title, a

contract of carriage and a receipt for goods.

The

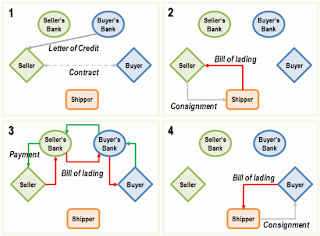

above figure provides the steps involved in a simple international transaction

between a seller and a buyer:

- A buyer and a seller agree upon

a transaction through a contract that specifies price, quantity, time and

place of delivery. Then the buyer will contact its bank to have a letter

of credit issued with the seller as beneficiary. This letter of credit can

either be funded by a loan and simply debited from the buyers account

balance if sufficient funding is available. If a loan is used, it is

subject to standard underwriting procedures involving a down payment, a

line of credit and interest rate based upon the buyer's credit worthiness.

Insurance is commonly required as a condition to issue a letter of credit

so that various risks, such as damage and delays, can be mitigated. The

bank commonly levy a fee ranging from 1 to 8% of the transaction,

depending on its value and complexity.

- With the letter of credit the

seller now has a line of credit available at its bank and final payment

will be made once the delivery conditions of the contract are satisfied.

The seller can then provide the consignment to a shipper in exchange of a

bill of lading promising that the consignment will be delivered at the

agreed destination. At this point the consignment is handled by the

transportation system and can involve the usage of port facilities,

warehouses, rail or trucks segments depending on the concerned transport

chain.

- The seller can then present to

bill of lading to its bank as an additional condition being meet to secure

final payment. It is important to underline that payment is not

necessarily provided to the seller immediately after the bill of lading is

provided, but after the buyer has taken ownership of the consignment and

confirmed that it meets the specification stated in the contract

(quantity, quality and condition). The bill of lading is then forwarded to

the buyer's bank in exchange of payment and afterwards to the buyer so

that the consignment can be claimed once delivered.

- The buyer is finally able to

provide the bill of lading to the shipper and claim the consignment. After

it has been confirmed, often by a neutral third party, that the

consignment meets the terms of the contract the seller can claim final

payment from its bank from the funds that were previously deposited.

It

is estimated that large commercial bank finance about 90% of all global trade

transactions. If for any reason the letter of credit cannot be cleared and

payment made the transaction cannot take place.

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন